Why Should I Check My Credit Reports and Credit Scores?

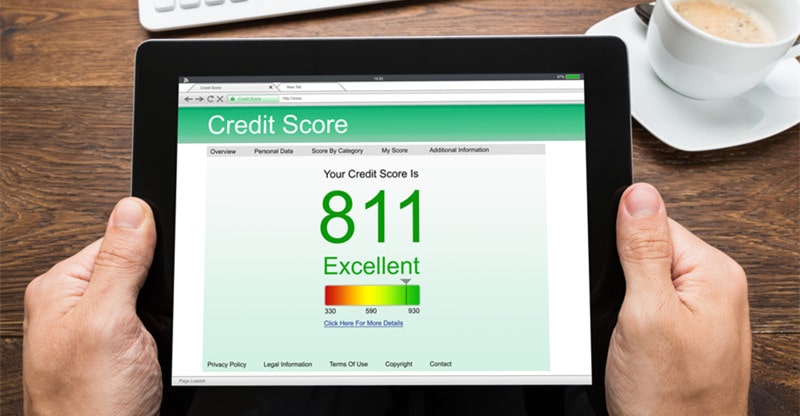

You may not have checked your credit report and score recently. Maybe you do not consider them important unless you are thinking of getting a loan or applying for a card. The credit score may not be of importance to you like other numbers such as your account balance or credit card balance.

But the truth is that you should check your credit report and credit score regularly. You should not buy into the misconception that checking them will hurt your credit score. As long as you use a credit scoring service, it won’t impact your credit negatively.

Here are some reasons why you should check your credit report and score regularly.

To know your status

You need to be aware of where your credit stands — whether good or bad, as it is a crucial part of your financial health that you cannot afford to ignore. Even if your score is bad, you are better off being aware than having no idea. Should you find that your score is good, then you will continue doing what it takes to maintain it.

Fortunately, even if it is bad, all is not lost as you can take some steps to rebuild it. One of the things that you can do is to engage experts in credit repair who can help you to buy credit lines with a good history and high rating to help to boost your score.

To confirm the accuracy of your report

It is possible for your credit report to contain errors, for instance, unreported debts that have been settled, incorrect personal details, and so on. Such report credit errors can affect your credit score negatively. It is important to keep checking whether all of the necessary updates are done and that your details are correct.

If there are errors, you can dispute them so they are rectified and could possibly improve your score. There are also instances of identity theft where fraudulent people can use your details and take loans or credit cards and default, leading to damage to your score. You can stop such situations if you check your report regularly.

To be prepared for the outcome of your credit application

Can you imagine applying for a loan or a credit card and having the application turned down? What if you get the credit at terms that are not as favorable as you thought?

These are possible scenarios if you are not sure of your credit report contents and credit rating. To avoid such surprises or to be well prepared for the outcome of your application, make it a habit to check your credit report and score.

To be sure your loan cosigner does not default

You could consign a loan with a friend or relative to help them get financing despite their poor score. However, if they default, you will be responsible for the debt. You will see it on your credit report if the person you consigned for defaults or pays late.

Even when the relationship between you and the cosigner is close, you should not take chances and should keep checking your credit report and score to confirm that they pay and that your score has not been decimated by their failure to keep to the terms of the credit contract.

Checking your credit report and credit score is critical for your financial health. You should comb through the report line by line as any error, say a wrongly reported account balance, can affect your score negatively. You need to check the two at least once per year.