Is Your Hobby Putting You in Debt? Here’s How to Get Out

Have you ever heard the quote about doing what you have to do so you can do what you want to do? For many people, hobbies are the motivation to work hard and fulfill life’s many obligations — doing what we have to do on a daily basis enables us to have the resources to pursue our passions, whether that’s painting, fixing cars, cooking, woodworking, fitness, photography or any other extracurricular activity.

There’s no doubt many of us feel hobbies are an important part of our identities and our mental health. They’re a way to blow off steam, get creative and connect with other like-minded folk. In general, it’s healthy to have one or more pastimes you enjoy outside of your career. The only time it can get dicey is if your hobby is putting you in debt.

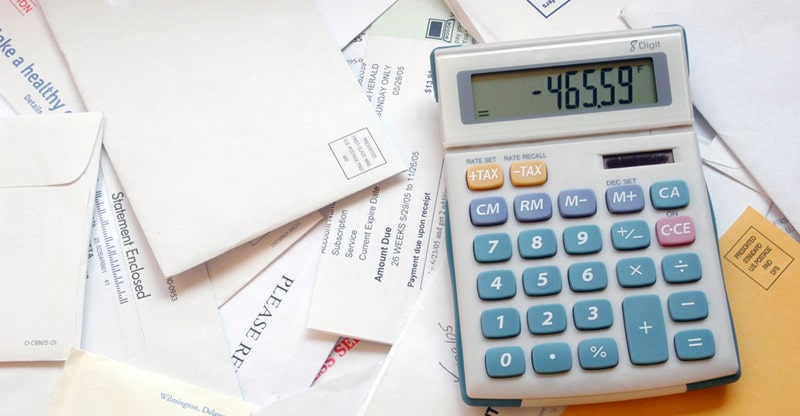

Is your hobby currently draining your finances?

Here’s how to stop this cycle without having to give up the activity you love altogether.

Create a Budget for Each Hobby

Building your hobbies into your budget is an important step — and the more specific you can get, the better. Instead of creating a general category for discretionary or fun spending, list your hobbies and assign a monthly spending limit to each one. This will help you evaluate how much you’re spending, why, and how you can lower that figure to a more reasonable number without having to cancel your beloved hobby altogether.

If you’re still unsure how much you’re spending on each hobby, or have been operating in denial because you’re nervous to find out, start by using a personal finance app to track your monthly expenses. This will give you a clear picture of where your money’s going; $25 dollars here, $50 dollars there can really add up over time. Then you can adjust your budget as you go, trimming the fat on your hobby-related costs and reallocating that money toward debt repayment and saving.

A basic rule of thumb is to keep spending on hobbies and entertainment below 10 percent of your total take-home pay.

Sell Hobby Supplies You Barely Use

Hobby equipment tends to beget more hobby equipment. Soon you’ve got a garage, attic, spare bedroom, storage unit or kitchen table full of supplies. One way to declutter and alleviate some debt is to sell these underused hobby supplies.

Debt relief expert and Freedom Debt Relief co-founder Andrew Housser recommends eliminating hobby equipment you haven’t touched in a year or more. If you can sell your used supplies to someone who can get some enjoyment out of them, it’ll be a win-win situation. Then apply your proceeds to your outstanding debts rather than rushing out to buy new materials.

Turn Your Hobby into a Side Hustle

Depending on the exact nature of your hobby, you may be able to turn it into a side hustle by monetizing your skills or products. You may decide to launch a small business around your passion, like taking photography commissions or selling your artistic creations on Etsy.

While there will likely be a lot more work and risk involved than if you were just practicing your hobby for your own enjoyment, this strategy is one way to potentially boost your income while still getting to do what you enjoy. Then you can funnel your extra earnings toward debt repayment efforts, helping you finance your hobby while chipping away at what you owe.

If your hobby is putting you in debt, it’s time to make a change. Budget for your passion projects, unload extra supplies you have sitting around and monetize your pastime if applicable.